Tripoley insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a focus on understanding the unique dynamics of this specialized coverage. This insurance concept encompasses various types of protection that cater to both individual and business needs, reflecting its historical evolution and importance in providing security against unforeseen circumstances.

As we delve deeper into the essentials of Tripoley insurance, we will explore its myriad benefits, how it compares to other insurances, and the key factors to consider when selecting a provider. By the end, you’ll gain insight into navigating this insurance landscape with confidence and clarity.

Overview of Tripoley Insurance

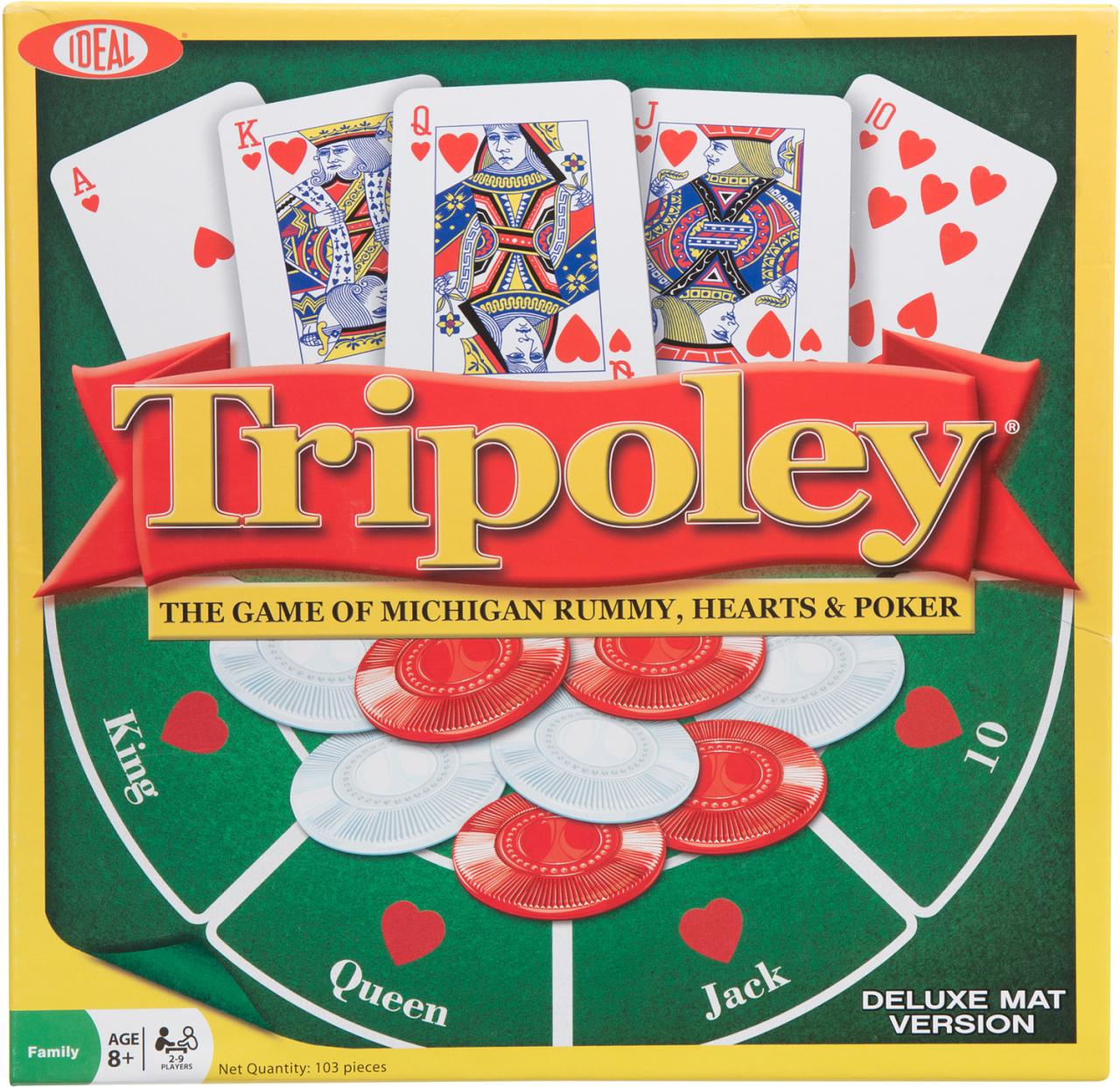

Tripoley insurance is a specialized form of coverage designed to protect individuals and businesses against various risks associated with their activities, particularly in the realm of leisure and gaming. This type of insurance is particularly relevant to those who engage in Tripoley, a popular card game that combines elements of Poker and Hearts, and involves betting and gaming stakes. By providing comprehensive coverage, Tripoley insurance aims to safeguard players and organizers from potential financial losses and liabilities that may arise during the game.Tripoley insurance encompasses a variety of coverage types tailored to meet the specific needs of participants. These inclusions often comprise general liability insurance, which protects against bodily injury or property damage claims, as well as coverage for professional liability, which addresses issues stemming from errors or omissions in the conduct of the game. Additionally, Tripoley insurance may also offer coverage for theft, loss of personal property, and even cancellation or interruption of events due to unforeseen circumstances. This multi-faceted approach ensures that players and event organizers can engage in the game with peace of mind, knowing they are financially protected.Historical Context and Evolution of Tripoley Insurance

The concept of Tripoley insurance has its roots in the broader evolution of gaming and recreational insurance. As the popularity of leisure activities increased throughout the 20th century, so did the need for specialized insurance products that addressed the unique risks associated with them. The emergence of organized gaming events, particularly in the 1970s and 1980s, spurred demand for insurance solutions that could protect against liabilities arising from such events.Initially, the coverage options available for gaming-related activities were limited and often lacked the specificity required to fully address the diverse risks involved. Over time, as awareness of legal liabilities and financial exposure grew, insurance providers began to develop more tailored products. Tripoley insurance emerged as a response to this demand, with policies designed to cover the distinct nuances associated with card games and tournaments. This evolution reflects a broader trend in the insurance industry toward more customized solutions that cater to the unique needs of niche markets, allowing participants in games like Tripoley to enjoy their activities while minimizing exposure to potential financial risks.Benefits of Tripoley Insurance

Tripoley Insurance offers a unique blend of coverage options that cater to various needs, providing policyholders with significant advantages over traditional insurance types. Understanding these benefits can help individuals and businesses make informed decisions about their insurance coverage.One of the primary advantages of Tripoley Insurance is its comprehensive coverage that combines elements of health, property, and liability insurance. This integrated approach not only simplifies the insurance process but also ensures that crucial areas of risk are covered under one policy. By having a unified insurance solution, policyholders can experience streamlined management of their insurance needs, reducing the complexities often associated with multiple policies.Key Advantages of Tripoley Insurance

The benefits of Tripoley Insurance can be summarized through several key advantages that set it apart from standard insurance offerings.- Comprehensive Protection: Tripoley Insurance provides extensive coverage options that protect against various unforeseen events, making it a versatile choice for individuals and businesses alike.

- Cost Efficiency: By bundling multiple types of coverage into a single policy, Tripoley Insurance can often present cost savings compared to purchasing separate policies for each type of coverage.

- Streamlined Claims Process: The integrated nature of the policy allows for a more efficient claims process, which is crucial during times of crisis when quick compensation is necessary.

- Enhanced Financial Security: Coverage through Tripoley Insurance can help safeguard your financial future by providing a safety net against unexpected expenses resulting from accidents, natural disasters, or health emergencies.

Comparison with Other Insurance Forms

Tripoley Insurance stands out in comparison to other forms of insurance due to its unique combination of coverage types. While traditional insurance policies may focus on singular aspects—such as auto, home, or health—Tripoley Insurance provides an all-in-one solution that meets diverse needs.“A single Tripoley policy can often equate to the benefits of several conventional policies combined, providing superior value and peace of mind.”This model not only reduces the administrative burden but also enhances the effectiveness of risk management strategies. For instance, businesses that opt for Tripoley Insurance can enjoy comprehensive coverage that protects their assets, employees, and overall operations under one roof, a feature that is often absent in conventional insurance arrangements.

Financial Security During Unforeseen Events

In times of crisis, having robust insurance coverage is essential for maintaining financial stability. Tripoley Insurance is designed to offer financial resilience when faced with unexpected events such as natural disasters, health emergencies, or liabilities stemming from accidents.The financial security provided by Tripoley Insurance helps mitigate the impact of unforeseen occurrences, allowing policyholders to recover faster without the burden of exorbitant out-of-pocket expenses. This is particularly beneficial for small businesses that may struggle to absorb the costs associated with unexpected disruptions.“Tripoley Insurance not only protects your assets but also ensures your financial peace of mind in turbulent times.”For example, consider a small business owner who faces significant property damage due to a flood. With Tripoley Insurance, the costs associated with repairs and lost revenue during the recovery period are covered, enabling them to focus on rebuilding and continuing operations rather than financial distress.

How to Choose a Tripoley Insurance Provider

Selecting the right Tripoley insurance provider is crucial to ensuring comprehensive coverage and peace of mind during your travels. With numerous options available, making an informed choice can significantly impact your travel experience. This section will guide you through the essential criteria to consider when evaluating different providers.Criteria for Selecting a Tripoley Insurance Provider

When assessing a Tripoley insurance provider, several criteria should be prioritized to ensure that you are receiving the best coverage for your needs. These criteria include:- Reputation and Reviews: Research customer feedback and ratings to gauge the provider's reliability. Look for testimonials on independent review sites to understand the experiences of other travelers.

- Coverage Options: Evaluate the specific coverage options available, including medical expenses, trip cancellations, lost baggage, and emergency evacuation. A comprehensive plan offers peace of mind and protects against various travel uncertainties.

- Pricing and Value: Compare premiums and deductibles among different providers. Ensure the policy provides good value for the coverage offered, balancing cost with necessary protection.

- Customer Service: Test the responsiveness and helpfulness of the customer support team. Reliable assistance is vital, especially in emergencies while traveling.

- Claim Process: Investigate the provider's claim process. A straightforward and transparent claims procedure can alleviate stress during difficult situations.

Checklist for Evaluating Tripoley Insurance Policies

A checklist can simplify the evaluation process of Tripoley insurance policies. Use the following points to compare and contrast different offerings effectively:- Is the provider licensed and regulated in your country?

- What is included in the base policy versus optional add-ons?

- Are there any exclusions or limitations that may affect your coverage?

- Does the policy provide coverage for pre-existing conditions?

- What are the limits on coverage amounts for various incidents?

- How does the policy handle emergency medical situations abroad?

- Are there any geographical limitations for coverage?

- What is the refund policy if you need to cancel or change your trip?

Tips for Negotiating Terms and Understanding Policy Details

Negotiating terms and fully understanding policy details is vital for securing the best Tripoley insurance for your travel needs. Consider the following tips:- Read the Fine Print: Carefully review all terms and conditions. Pay close attention to exclusions and coverage limits to avoid surprises later.

- Ask Questions: Don’t hesitate to seek clarification from the provider about any confusing terms or details. It’s better to be informed than to assume.

- Consider Bundling: If you have multiple types of insurance needs, inquire about bundling your Tripoley insurance with other policies for potential discounts.

- Negotiate Premiums: Use comparisons from other providers to negotiate better rates or coverage options that suit your budget and requirements.

- Understand the Cancellation Policy: Be clear on terms related to cancellations and refunds, especially if travel plans are subject to change.

Choosing the right Tripoley insurance provider is about more than just price; it's about finding the right balance between coverage and value, ensuring a worry-free travel experience.

Frequently Encountered Issues with Tripoley Insurance

Common Pitfalls in Tripoley Insurance Claims

Submitting claims with Tripoley insurance can sometimes lead to complications. It is crucial to be aware of potential pitfalls that may arise during the claims process. Highlighted below are some frequent issues encountered by policyholders:- Insufficient Documentation: One of the primary reasons claims are denied is the lack of proper documentation. It's essential to provide all requested documents, including proof of loss, receipts, and any other relevant information.

- Missed Deadlines: Failing to file a claim within the specified time frame can result in denial. Each policy will have its own deadlines that policyholders must adhere to.

- Misinterpretation of Policy Terms: Many policyholders misinterpret the coverage limits or exclusions in their policy, leading to surprise denials. It’s vital to thoroughly understand the policy language before filing a claim.

- Failure to Report Incidents Promptly: Delaying the reporting of an incident can affect the claim's outcome. Insurers expect timely reporting to investigate claims accurately.

Common Questions and Concerns of Policyholders

Policyholders often have specific questions or concerns regarding their Tripoley insurance policies and claims. Being informed on these common inquiries can help mitigate confusion:- What is covered under my policy? Understanding the specific coverage provided by a Tripoley insurance policy is crucial. Coverage can vary widely, and knowing what is included helps prevent unexpected issues when filing a claim.

- How will my claim be processed? Many policyholders seek clarity on the claims process, including what steps to expect and the timeline for claim resolution.

- What should I do if my claim is denied? Knowing the steps to take in case of a denial can empower policyholders to seek resolution, from understanding the reason for denial to pursuing an appeal.

- How are claim payouts determined? Questions regarding payout calculations are common. Policyholders often want to know how insurers assess losses and determine monetary compensation.

Resolving Disputes with Tripoley Insurance Providers

Disputes with Tripoley insurance providers can arise at any stage of the insurance process. Effective dispute resolution strategies are essential for policyholders to achieve satisfactory outcomes:- Review the Policy and Claim Details: Begin by thoroughly reviewing your policy and understanding the grounds for your claim or dispute. This foundational knowledge is critical for any further action.

- Communicate Clearly and Document Everything: When contacting your insurance provider, ensure all communications are documented. Keeping a record of conversations, emails, and submitted documents can be beneficial.

- Request a Detailed Explanation: If a claim is denied or if you encounter issues, request a detailed written explanation from the insurer. This can provide insight into their decision-making process and help identify potential areas for appeal.

- Engage with a Mediator: If direct communication with the insurance provider does not lead to resolution, consider involving a mediator. Many disputes can be resolved through mediation without resorting to legal action.

- Consider Legal Action as a Last Resort: If all else fails, legal action may be necessary. Engaging with an attorney who specializes in insurance disputes could be a viable option, but it should be considered only after exhausting all other avenues.

Quick FAQs

What is Tripoley insurance?

Tripoley insurance is a specialized type of insurance that provides coverage against various risks, catering to both individuals and businesses. It includes multiple forms of protection tailored to unique needs.

How does Tripoley insurance compare to other insurances?

Tripoley insurance typically offers more comprehensive coverage options than standard insurance, providing a broader safety net for unexpected events.

What should I look for when choosing a Tripoley insurance provider?

Focus on the provider's reputation, customer service, policy offerings, and the flexibility of terms to ensure you select the best match for your needs.

How can I resolve issues with my Tripoley insurance claims?

It's essential to communicate clearly with your provider, keep thorough documentation, and understand the claims process to resolve disputes effectively.

What common pitfalls should I avoid with Tripoley insurance?

Be cautious of underinsurance, misunderstanding policy terms, and not keeping your coverage updated as your needs change.

When it comes to protecting your assets, understanding seguro geico can be a game changer. This insurance option offers tailored plans to meet your specific needs, ensuring that you're covered in various situations. It's essential to evaluate what each policy covers, so you’re not left in the dark when you need help the most.

Choosing the right car insurance is crucial for any vehicle owner. Not only does it provide financial protection in case of accidents, but it also gives peace of mind. By comparing different policies and understanding their benefits, you can find a plan that suits your driving habits and budget perfectly.