With state farm seguros taking the lead, this journey reveals the essence of a trusted insurance provider that has been serving customers for decades. This captivating narrative unravels the rich history of State Farm Seguros, showcasing the diverse range of insurance products it offers and the regions it serves, inviting readers to explore how it stands out in the competitive landscape of insurance.

State Farm Seguros has built a formidable reputation in the insurance industry, providing comprehensive coverage options tailored to meet the unique needs of customers across various geographical areas. With a focus on customer service excellence and an array of innovative products, State Farm Seguros continues to be a preferred choice for individuals seeking reliable insurance solutions.

Overview of State Farm Seguros

State Farm Seguros is a prominent insurance company in the United States, known for its comprehensive range of insurance products and exceptional customer service. Established in 1922 by George J. Mecherle, State Farm began as a mutual automobile insurance company, catering primarily to farmers. Over the decades, it has evolved into one of the largest providers of various insurance types, expanding its reach and services across the nation and beyond. With its headquarters in Bloomington, Illinois, State Farm has built a reputation for reliability and trustworthiness in the insurance market.State Farm Seguros offers a diverse portfolio of insurance products tailored to meet the needs of individuals, families, and businesses. These products include auto insurance, homeowners insurance, renters insurance, life insurance, and health insurance, among others. Additionally, the company provides services such as banking and investment products, demonstrating its commitment to being a one-stop shop for financial security. The variety of coverage options allows customers to choose policies that best suit their specific requirements, ensuring peace of mind in various life situations.Types of Insurance Products Offered

State Farm Seguros is recognized for its extensive range of insurance offerings, designed to protect clients across different aspects of their lives. The importance of diversifying insurance products cannot be understated, as it allows customers to safeguard their assets comprehensively. Below are the primary types of insurance products offered:- Auto Insurance: Covers damages to vehicles and liability for bodily injury and property damage in the event of an accident.

- Homeowners Insurance: Offers protection for homes and personal property against risks such as fire, theft, and certain natural disasters.

- Renters Insurance: Provides coverage for personal belongings within a rented property and liability protection for accidents that occur at the rental site.

- Life Insurance: Ensures financial security for beneficiaries in the event of the policyholder's death, with options including term and whole life insurance.

- Health Insurance: Offers coverage for medical expenses, including doctor visits, hospital stays, and prescription medications.

Geographical Regions of Operation

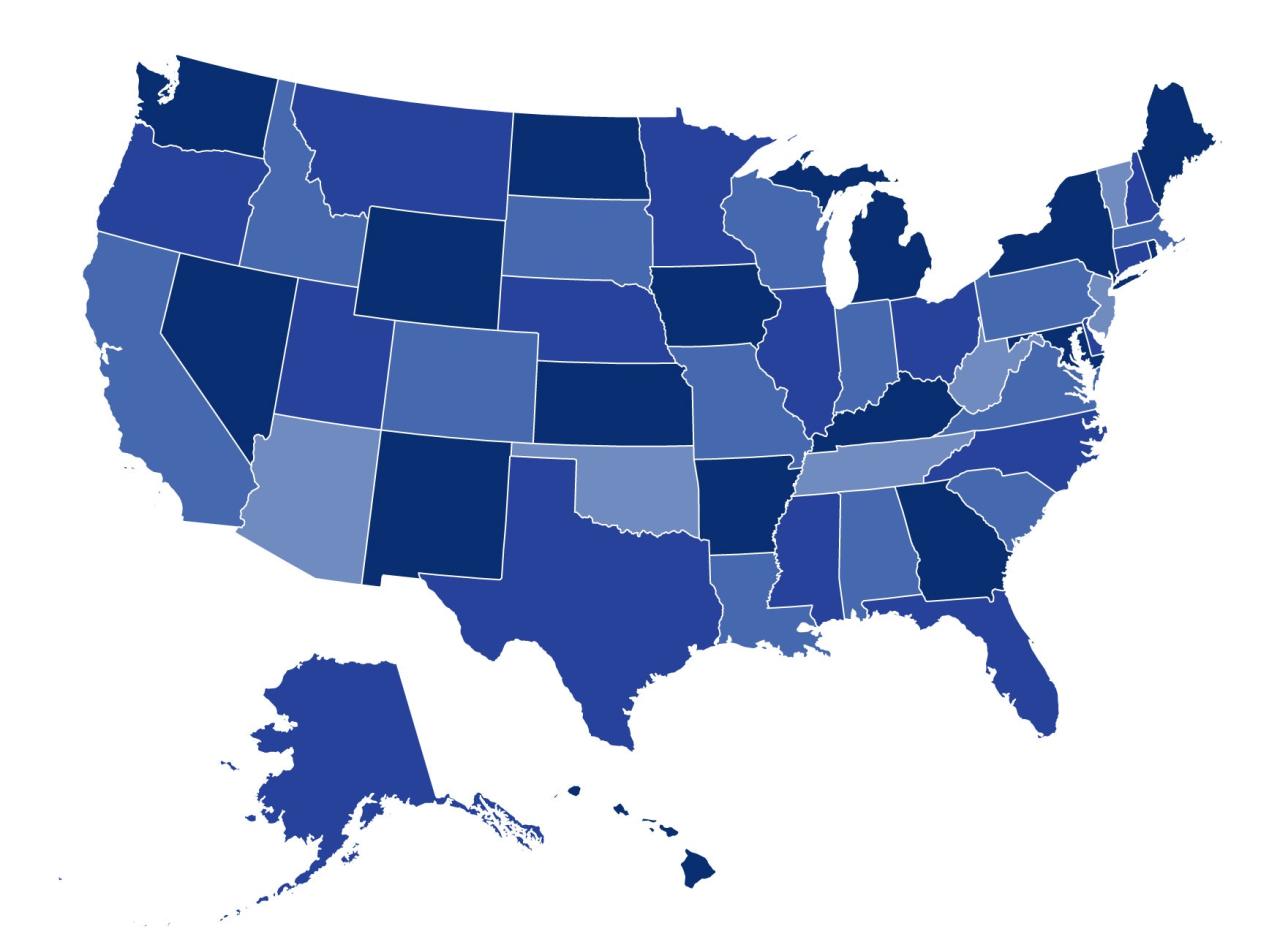

State Farm Seguros operates across multiple geographical regions, primarily throughout the United States. Its vast network of agents and offices allows for localized service, making it accessible to a broad range of customers. The company has a significant presence in both urban and rural areas, ensuring that individuals from various backgrounds have access to its services. In addition to its operations in the U.S., State Farm has also expanded its reach to international markets through partnerships and subsidiaries, providing insurance solutions to clients beyond American borders. This strategic growth demonstrates the company's commitment to becoming a global leader in the insurance industry, adapting its products to meet the needs of diverse populations across different regions."State Farm Seguros stands as a testament to the importance of adaptable insurance solutions, meeting the needs of millions across various demographics."

Benefits of Choosing State Farm Seguros

Key Advantages of State Farm Seguros

State Farm Seguros stands out in the insurance landscape due to its numerous benefits, including:- Extensive Coverage Options: State Farm provides a wide array of insurance products, including auto, home, life, and health insurance. This diversity allows customers to bundle policies, often resulting in additional savings.

- Financial Stability: With a long-standing history and strong financial ratings, State Farm instills confidence in its customers, ensuring that claims are paid reliably.

- Customizable Policies: Customers can tailor their coverage to fit personal needs, whether they require basic protection or comprehensive plans.

- Discounts and Savings: State Farm offers various discounts, such as multi-policy, safe driver, and good student discounts, helping policyholders save money.

Customer Service Features

State Farm's commitment to exceptional customer service is paramount in distinguishing itself from competitors. The following features highlight this aspect:- 24/7 Availability: Customers can access support anytime, ensuring that assistance is always a call or click away.

- Personalized Service: State Farm agents provide individualized attention, helping customers navigate their options and make informed decisions.

- User-Friendly Online Services: The State Farm website and mobile app offer easy access to policy management, claims filing, and support resources.

- Community Engagement: State Farm actively participates in community initiatives, reinforcing its dedication to customer relationships and corporate responsibility.

Testimonials from Satisfied Clients

Real-life experiences from customers illustrate the effectiveness and reliability of State Farm Seguros. Here are a few notable testimonials:"I switched to State Farm for my auto insurance, and the savings were incredible. The agent was knowledgeable and helped me find the best coverage for my needs." – Anna P.

"After a minor accident, State Farm made the claims process so easy. I was impressed by their prompt response and the way they handled everything." – John D.

"I appreciate how State Farm truly cares about their clients. They helped me navigate my policy options and even provided advice on additional coverage that fit my lifestyle." – Maria L.

Comparing State Farm Seguros with Other Providers

When it comes to choosing an insurance provider, understanding the differences in coverage, pricing, and customer service is essential. State Farm Seguros stands out among its competitors, but how does it truly measure up against other leading providers? This section provides a comprehensive comparison to help you make an informed choice.Comparison Table of Insurance Providers

To gain a clearer understanding of how State Farm Seguros compares to other insurance providers, the following table highlights key factors, including coverage options, pricing, and customer service ratings:| Provider | Coverage Options | Pricing (Average Monthly Premium) | Customer Service Rating |

|---|---|---|---|

| State Farm Seguros | Comprehensive, Collision, Liability, Homeowners | $120 | 4.5/5 |

| Allstate | Comprehensive, Collision, Liability, Renters | $130 | 4.2/5 |

| Geico | Comprehensive, Collision, Liability, Motorcycle | $100 | 4.4/5 |

| Progressive | Comprehensive, Collision, Liability, Business Insurance | $115 | 4.1/5 |

Unique Selling Points of State Farm Seguros

State Farm Seguros offers several unique features that distinguish it from other insurance providers- Personalized Service: State Farm is known for its personalized service through local agents who provide tailored advice based on individual needs.

- Comprehensive Coverage: The company offers various coverage options, including unique add-ons that cater to specific needs, such as pet insurance and identity theft protection.

- Community Involvement: State Farm actively participates in community programs, enhancing its reputation and building customer trust.

- Mobile App: Their user-friendly app allows customers to manage their policies, file claims, and access customer support easily.

Customer Satisfaction Ratings

Customer satisfaction ratings are a vital consideration when evaluating insurance providers. State Farm Seguros consistently receives high ratings from its customers, reflecting positive experiences and trust in the service."State Farm Seguros has a 4.5 out of 5 customer satisfaction rating, which is higher than many competitors, indicating a strong commitment to customer service."In contrast, while other competitors also show favorable ratings, State Farm Seguros excels in specific areas such as ease of claims processing and the quality of customer interactions, contributing to its overall higher satisfaction levels. This commitment to customer service not only sets State Farm apart but also reinforces its position as a reliable choice for insurance needs.

Claim Process and Customer Experience: State Farm Seguros

Filing a claim can often be a daunting experience, but with State Farm Seguros, the process is designed to be straightforward and user-friendly. Understanding the steps involved and utilizing helpful tips can significantly enhance your experience when navigating a claim.The claim process at State Farm Seguros is structured to ensure that customers receive timely assistance and fair compensation for their losses. Here’s a detailed breakdown of the steps you’ll typically follow when filing a claim:Step-by-Step Process for Filing a Claim

To help you navigate the claim process efficiently, it is essential to follow these steps:- Report the Incident: As soon as the incident occurs, contact State Farm Seguros through their 24/7 claims hotline or online portal. Be prepared to provide essential details regarding the event.

- Gather Necessary Documentation: Collect all relevant documents, including police reports, photographs of damages, and any other evidence that supports your claim.

- Submit Your Claim: Fill out the claim form with accurate and detailed information. Submit this form along with the gathered documents through the preferred method, whether online or by phone.

- Claim Assignment: Once submitted, a claims adjuster will be assigned to your case. They will contact you to discuss the details and may schedule an inspection of the damages.

- Evaluation: The claims adjuster will assess the damages and review your submitted documentation to determine the validity and extent of your claim.

- Claim Resolution: After evaluation, you will receive a decision regarding your claim. If approved, details about compensation and next steps will be provided.

Tips for Maximizing Benefits During the Claim Process, State farm seguros

To ensure that you receive the best possible outcome from your claim, consider the following tips:Be thorough and honest when providing information during the claim process.These strategies can enhance your experience:

- Be prompt in reporting the incident to avoid any delays in processing your claim.

- Document everything meticulously; take photos of the damage and keep records of all communication related to your claim.

- Understand your policy coverage to know what is included in your claim, as this knowledge can empower you during discussions with your adjuster.

- Follow up regularly with your claims adjuster to stay informed on the status of your claim.

- Ask questions if you do not understand any part of the process or the adjustments being made to your claim.

Customer Feedback and Experiences

Gauging customer experiences provides valuable insight into the effectiveness of the claim process at State Farm Seguros. Feedback from policyholders generally reflects positive sentiments, with many appreciating the speed and efficiency of the claims team.Common themes among customer reviews include:- Quick response times, with many claims being processed faster than expected.

- Professional and courteous claims adjusters who guided customers through the process with clarity.

- A high level of satisfaction regarding the compensation received, aligning closely with policy terms.

- Some customers noted the importance of keeping detailed records to expedite their claims process.

FAQ Insights

What types of insurance products does State Farm Seguros offer?

State Farm Seguros provides a variety of insurance products, including auto, home, life, and health insurance, catering to diverse customer needs.

How does State Farm Seguros compare in pricing with other providers?

State Farm Seguros typically offers competitive pricing, but it's advisable to compare quotes from multiple providers for the best rates.

What is the average customer satisfaction rating for State Farm Seguros?

State Farm Seguros enjoys high customer satisfaction ratings, often noted for its reliable service and prompt claims processing.

Can I manage my State Farm Seguros policies online?

Yes, State Farm Seguros offers an online platform where customers can manage their policies, file claims, and access customer support easily.

How long does it typically take to process a claim with State Farm Seguros?

Claim processing times can vary, but many customers report receiving timely updates and resolutions, often within a few days to weeks.

When it comes to reliable coverage, progreso insurance stands out for its comprehensive policies tailored to meet diverse needs. This option is particularly appealing for those looking for robust protection without sacrificing affordability, ensuring peace of mind in various situations.

For individuals seeking a comprehensive safety net, seguro estrella insurance offers various plans that cater to different lifestyles and budgets. Their flexible approach allows clients to customize their coverage, ensuring that essential aspects of life are protected efficiently.