Century Insurance stands out as a reliable ally in the world of coverage, offering an array of insurance products designed to meet diverse needs. With a rich history that reflects its growth and adaptation, Century Insurance has evolved to serve a wide demographic, ensuring financial security for individuals and families alike. From auto to life insurance, the company provides tailored solutions that resonate with various lifestyles and requirements.

As the insurance landscape continues to change, Century Insurance remains committed to delivering exceptional services that cater to the unique challenges faced by its customers. By understanding the key markets it serves, Century Insurance positions itself as a vital resource for those seeking comprehensive protection against uncertainties.

Overview of Century Insurance

Century Insurance stands as a prominent player in the insurance industry, offering a comprehensive suite of services designed to meet the diverse needs of individuals and businesses. Founded with the mission of providing reliable and innovative insurance solutions, Century Insurance has established itself as a trusted partner in risk management and financial security. The company’s core services encompass various types of insurance, including life, health, property, and casualty insurance, ensuring that clients receive tailored coverage for their specific requirements.The evolution of Century Insurance traces back to its inception, where it began as a small firm dedicated to serving local communities. Over the years, it has grown significantly, adapting to the changing landscape of the insurance market and expanding its reach both geographically and in the range of services offered. The company has embraced technological advancements, enhancing its service delivery through digital platforms and customer-centric solutions. Today, Century Insurance serves millions of clients across various sectors, including retail, manufacturing, and healthcare, reflecting its broad market appeal and commitment to excellence.Key Markets and Demographics Served by Century Insurance

The diverse clientele of Century Insurance spans a wide array of markets and demographics, showcasing its ability to cater to various needs effectively. The company focuses on several key areas, which include:- Individual Consumers: This segment encompasses families and individuals seeking personal insurance solutions, including life, health, and property insurance. Century Insurance provides customized policies that cater to different life stages and financial circumstances.

- Small and Medium Enterprises (SMEs): Recognizing the unique challenges faced by SMEs, Century Insurance offers tailored business insurance packages that include commercial property, liability, and workers’ compensation insurance. This support is vital for the sustainability of small businesses.

- Corporate Clients: Large corporations turn to Century Insurance for comprehensive risk management solutions. The company provides specialized insurance products designed to protect against various operational risks, including commercial auto, umbrella liability, and cyber risk insurance.

- Healthcare Sector: With the growing demand for healthcare coverage, Century Insurance has developed specific products for healthcare providers and organizations, addressing their unique insurance needs and regulatory requirements.

- Community and Non-Profit Organizations: Century Insurance also serves non-profit entities, offering them affordable insurance solutions that help safeguard their missions and activities.

Types of Insurance Products Offered: Century Insurance

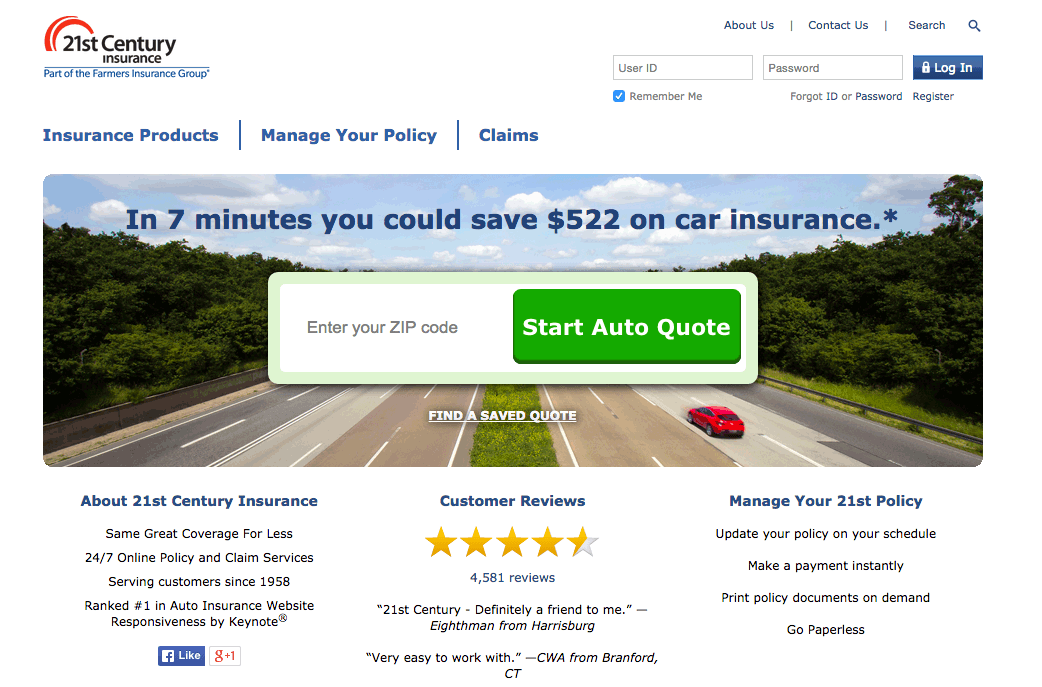

Auto Insurance

Century Insurance's auto insurance policies are designed to provide comprehensive protection for vehicles and drivers. The unique features of these policies often include:- Collision Coverage: Covers damages to your vehicle resulting from a collision with another vehicle or object.

- Comprehensive Coverage: Protects against non-collision-related incidents such as theft, vandalism, or natural disasters.

- Liability Coverage: Offers financial protection against damage or injury you may cause to others while driving.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers regardless of fault.

Home Insurance

Home insurance policies from Century Insurance provide vital protection for homeowners against various risks. Key features of home insurance include:- Dwelling Coverage: Safeguards the structure of the home from perils like fire, wind, or vandalism.

- Personal Property Coverage: Insures belongings within the home, such as furniture and electronics, against specified risks.

- Liability Protection: Offers coverage in case someone is injured on your property, protecting you from potential lawsuits.

- Additional Living Expenses: Covers the cost of living elsewhere while your home is being repaired after a covered loss.

Life Insurance

Century Insurance provides a variety of life insurance products, allowing individuals to secure their family's financial future. Key aspects of these life insurance policies include:- Term Life Insurance: Provides coverage for a specified period, offering a death benefit to beneficiaries if the insured passes away during that term.

- Whole Life Insurance: Offers lifelong coverage with a savings component that accumulates cash value over time.

- Universal Life Insurance: A flexible policy that combines life coverage with a cash value component that earns interest.

Commercial Insurance

For businesses, Century Insurance offers a range of commercial insurance products tailored to meet the unique needs of different industries. Essential coverages include:- General Liability Insurance: Protects businesses from claims of bodily injury, property damage, and personal injury.

- Property Insurance: Covers damages to business property due to fire, theft, or other risks.

- Workers' Compensation Insurance: Provides coverage for employees injured on the job, including medical expenses and lost wages.

- Professional Liability Insurance: Protects against claims of negligence or misconduct in professional services.

Customer Experience with Century Insurance

Customer Testimonials and Case Studies

Numerous testimonials reflect the positive experiences of customers who have engaged with Century Insurance. For instance, one customer highlighted their satisfaction with the swift resolution of a property damage claim, stating,"The claims adjuster was incredibly understanding and responsive, which made a challenging situation much easier to handle."Another case study involved a family that benefited from Century Insurance's auto coverage after an accident. They appreciated the thorough communication provided by the claims team, who kept them informed and reassured throughout the entire process.

Claims Process Expectations, Century insurance

Understanding what to expect during the claims process can significantly alleviate anxiety for policyholders. The following Artikels the typical steps involved in a claim with Century Insurance:1. Initial Report: The process begins with the customer reporting the incident to the claims department via phone or online portal. 2. Documentation Submission: Customers must gather and submit necessary documents, which may include police reports, photographs, or medical records, depending on the claim type. 3. Claim Review: A claims adjuster evaluates the submitted information to determine coverage and claim validity. 4. Communication: Throughout the review process, the adjuster maintains communication, providing updates and requesting any additional documentation if needed. 5. Settlement: Upon approval, the settlement amount is determined, and the payment process begins, allowing customers to recover losses efficiently.Customers can expect timely communication and support at each step, reinforcing Century Insurance's commitment to customer satisfaction.Customer Service Reputation Comparison

When comparing Century Insurance's customer service reputation to competitors within the industry, several key factors emerge. Century Insurance is often noted for its personalized service and quick response times. In surveys, customers have rated them highly for their knowledgeable agents and efficient claims handling, often surpassing industry averages.Competitors may offer various services, but Century Insurance distinguishes itself by fostering long-term relationships with clients. Many customers express appreciation for the accessibility of their representatives and the thorough explanations provided during the claims process. This level of service contributes to high customer retention rates and positive word-of-mouth referrals, showcasing Century Insurance's strong standing in the market.Financial Strength and Ratings

Rating Agencies and Their Criteria

Various agencies are tasked with evaluating and rating Century Insurance’s financial strength, each utilizing distinct methodologies and criteria. Understanding these agencies and their ratings is essential for customers looking to make informed decisions.The primary rating agencies include:- A.M. Best: A.M. Best is known for focusing specifically on the insurance industry. It rates companies based on their financial strength, operating performance, and business profile, using a comprehensive analysis of financial data and industry conditions.

- Standard & Poor's (S&P): S&P evaluates insurers based on creditworthiness, assessing factors like financial metrics, market position, and risk management practices. Their ratings provide a broader perspective on an insurer’s financial stability.

- Moody's: Moody’s offers ratings that reflect the credit risk associated with insurance companies. They analyze past performance, current financials, and future prospects to assign ratings that inform investors and customers alike.

“The ratings from these agencies serve as a critical benchmark for consumers, helping them to gauge the financial health and reliability of their insurance providers.”The importance of these ratings cannot be overstated, as they provide a transparent and objective measure of an insurer's fiscal soundness, guiding consumers in selecting a trustworthy insurance partner. Century Insurance, with its solid financial ratings, exemplifies a reliable choice for those seeking peace of mind in their insurance coverage.

FAQ Guide

What types of insurance does Century Insurance offer?

Century Insurance provides various insurance products, including auto, home, life, and more specialized coverage options.

How can I customize my insurance policy with Century Insurance?

Customers can explore different add-ons and optional coverages to tailor their policies according to their specific needs.

What is the claims process like with Century Insurance?

The claims process is straightforward, with dedicated support to guide customers through each step, ensuring a smooth experience.

How does Century Insurance's customer service compare to its competitors?

Century Insurance is recognized for its exceptional customer service, often receiving positive feedback when compared to industry competitors.

What financial ratings does Century Insurance hold?

Century Insurance maintains strong financial stability and receives high ratings from various agencies, reflecting its reliability in the insurance sector.

The Samsung Note7 was a groundbreaking device that introduced features like an advanced camera and vibrant display, but its legacy was marred by battery issues. Despite the controversy, it paved the way for innovations in subsequent models, showcasing Samsung's commitment to pushing the boundaries of smartphone technology.

In recent years, Samsung's entry into the automotive sector has been gaining traction, with plans to integrate advanced technology into vehicles. This move highlights the brand's ambition to merge electronics with automotive innovation, promising a future where smart features enhance driving experiences.