Life insurance is a vital tool in the realm of financial planning, serving as a safety net for individuals and families alike. It ensures that loved ones are protected in the event of an unforeseen tragedy, allowing for peace of mind amidst life's uncertainties.

This essential policy comes in various forms, including term and whole life insurance, each designed to meet different needs. Understanding these options empowers consumers to make informed decisions, ultimately securing their financial future.

Understanding Life Insurance

Comparison of Term Life Insurance and Whole Life Insurance

Term life insurance and whole life insurance are the two primary categories of life insurance policies, each serving distinct purposes and catering to different financial needs. Term life insurance is designed to provide coverage for a specific period, usually ranging from 10 to 30 years. It is generally more affordable than whole life insurance, making it an attractive option for individuals looking for temporary coverage to protect their dependents during critical financial years. Whole life insurance, on the other hand, is a permanent policy that remains in effect throughout the insured's lifetime, as long as premiums are paid. This type of policy not only provides a death benefit but also accumulates cash value over time, which can be accessed by the policyholder through loans or withdrawals. The key differences between term and whole life insurance can be summarized as follows:- Duration of Coverage: Term life insurance covers a set period; whole life insurance provides lifelong coverage.

- Cost: Term insurance typically has lower premiums compared to whole life insurance, making it more budget-friendly.

- Cash Value: Whole life policies accumulate cash value, while term policies do not.

- Purpose: Term insurance is often used for short-term financial obligations, whereas whole life is suitable for long-term financial planning and wealth transfer.

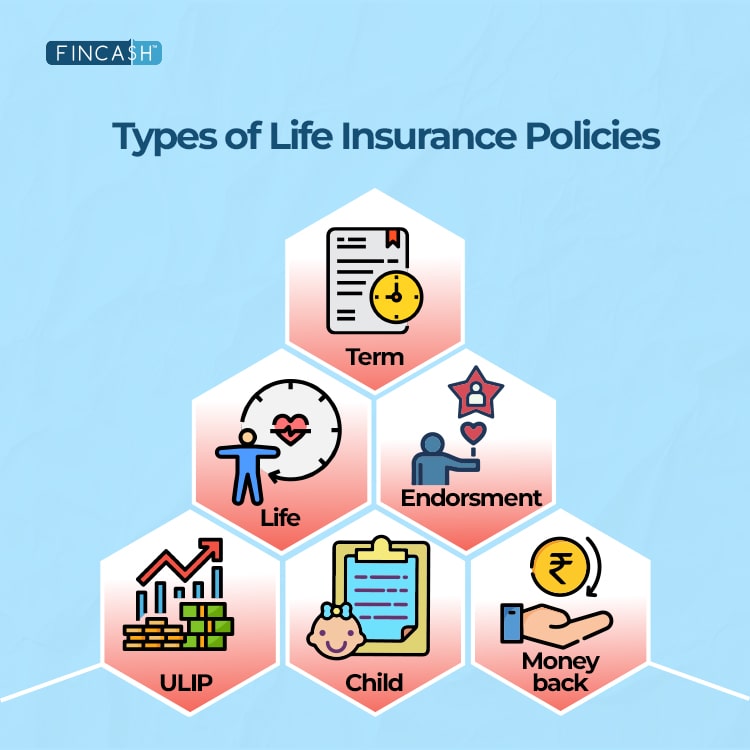

Types of Life Insurance Policies Available in the Market

Several types of life insurance policies cater to various needs and preferences. Understanding the nuances of these options can help individuals choose the right coverage for their circumstances. The most prominent types of life insurance policies include:- Term Life Insurance: As previously discussed, this policy offers coverage for a specified duration and is ideal for temporary financial obligations.

- Whole Life Insurance: This policy provides lifelong coverage and builds cash value, serving both protection and investment purposes.

- Universal Life Insurance: A flexible policy that combines life insurance with a savings component, allowing policyholders to adjust premiums and death benefits over time.

- Variable Life Insurance: This type allows policyholders to invest the cash value in various investment options, with the death benefit fluctuating based on the performance of these investments.

- Indexed Universal Life Insurance: A hybrid product that credits cash value based on a stock market index's performance, providing potential for higher returns while offering downside protection.

"Choosing the right life insurance policy is not just about coverage; it’s about ensuring financial security for your loved ones in unforeseen circumstances."In conclusion, understanding the different types of life insurance policies and their features is essential for making informed decisions that align with personal financial goals and family needs.

Benefits of Life Insurance

Financial Security During Unexpected Events

The financial support provided by life insurance can alleviate the economic impact of losing a primary breadwinner. The death benefit can be utilized for several critical expenses, including:- Mortgage Payments: Ensuring that the family home remains secure without the pressure of mortgage payments.

- Education Costs: Helping to fund children's education, ensuring their future opportunities are not compromised.

- Debt Clearance: Paying off any outstanding debts, which prevents financial strain on surviving family members.

- Daily Living Expenses: Assisting with ongoing living expenses, such as groceries and utilities, to maintain family stability.

Role of Life Insurance in Estate Planning and Wealth Transfer

In estates where wealth is accumulated, life insurance serves as an effective vehicle for transferring wealth across generations. By providing a death benefit, life insurance facilitates the smooth transition of assets, avoiding potential tax burdens and ensuring that wealth is passed down to heirs. The following factors highlight the importance of life insurance in this context:- Tax Benefits: Life insurance proceeds are generally not subject to income tax, allowing beneficiaries to receive the full benefit without deductions.

- Liquidity for Estate Settlement: In cases where estate taxes are due, life insurance can provide the necessary liquidity to cover these costs, preventing the forced sale of assets.

- Equal Inheritance: Life insurance can ensure equitable distribution of assets among heirs, providing a straightforward way to balance inheritances.

- Business Continuation: For business owners, a life insurance policy can fund buy-sell agreements, ensuring business stability and continuity after an owner’s death.

Choosing the Right Life Insurance Policy

Factors to Consider When Selecting a Life Insurance Provider

When choosing a life insurance provider, it is essential to evaluate several factors to ensure you partner with a reliable company. The following aspects should be considered:- Financial Stability: Research the company’s financial ratings from independent agencies, as this indicates their ability to pay claims in the long run.

- Policy Options: Ensure the provider offers a range of policy types (i.e., term, whole, and universal life insurance) to fit your specific needs.

- Customer Service: Assess customer reviews and ratings to gauge the quality of service provided, particularly when it comes to claims processing.

- Premium Costs: Compare multiple providers to understand the cost of premiums and any potential increases over time.

- Additional Benefits: Look for riders or add-ons that can enhance your policy, such as critical illness coverage or accidental death benefits.

Mistakes to Avoid When Purchasing Life Insurance

Several common pitfalls can lead to inadequate coverage or financial strain in the long run. Being aware of these mistakes can help you navigate the purchasing process more effectively:- Underestimating Coverage Needs: Many people make the mistake of selecting a policy that doesn’t adequately reflect their financial obligations. It is vital to calculate your total debts and future expenses accurately.

- Focusing Solely on Premiums: While affordability is important, opting for the cheapest policy may result in insufficient coverage. Always balance cost with the quality of coverage.

- Failing to Review Policies Regularly: Life changes, such as marriage, having children, or career changes, can alter your insurance needs. Regularly reviewing your policy ensures it remains aligned with your current situation.

- Ignoring Policy Exclusions: Be sure to read and understand the exclusions in your policy. Certain causes of death may not be covered, which could affect your beneficiaries’ payouts.

- Not Seeking Professional Advice: Engaging a financial advisor or insurance agent can provide valuable insights tailored to your unique situation, helping you make informed decisions.

Life Insurance Claims Process

Filing a claim for a life insurance policy is a critical step that beneficiaries must navigate during a difficult time. Understanding the claims process is essential to ensure a smooth experience and receive the benefits intended to provide financial support. This guide Artikels the essential steps, required documentation, and common challenges faced during the claims process.Steps Involved in Filing a Claim

The life insurance claims process involves several key steps that beneficiaries should follow to ensure successful claim processing. Familiarity with these steps can reduce delays and enhance the overall experience.- Notify the Insurance Company: The first step is to contact the insurance provider. This can typically be done through their customer service number or website.

- Obtain the Claim Form: Once notified, the insurer will provide a claim form. This form is crucial for initiating the claims process.

- Complete the Claim Form: Fill out the claim form accurately, providing all required information related to the policy and the deceased.

- Gather Required Documentation: Collect all necessary documents as specified by the insurer to support your claim.

- Submit the Claim: Send the completed form and documentation to the insurance company, keeping copies for your records.

- Follow Up: Regularly follow up with the insurance company to check on the status of the claim and address any further requirements promptly.

Documentation Required for Successful Claim Processing

Proper documentation is essential in facilitating a smooth claims process. Insurers require specific documents to verify the claim and establish eligibility for benefits.The following documents are typically needed:- Death Certificate: An official death certificate is required to confirm the passing of the policyholder.

- Claim Form: A fully completed claim form must be submitted as part of the application process.

- Policy Document: The original life insurance policy document or a copy is essential to verify the terms of coverage.

- Identification: Government-issued identification of the beneficiary may be required to authenticate their identity.

- Proof of Relationship: Documentation proving the relationship between the deceased and the beneficiary, such as marriage certificates or birth certificates, may be necessary.

Common Challenges Faced During the Claims Process

While the claims process is straightforward, several challenges can arise that may complicate matters for beneficiaries. Awareness of these potential hurdles can help mitigate issues.Among the common challenges are:- Incomplete Documentation: Submitting incomplete or incorrect documents can delay the claims process. It's crucial to double-check all paperwork before submission.

- Policy Exclusions: Some claims may be denied due to specific exclusions in the policy. Beneficiaries should review the policy details meticulously to understand the terms.

- Delayed Response from the Insurer: Insurance companies may take time to evaluate claims, which can be frustrating. Regular communication can help keep the process on track.

- Disputes Over Beneficiary Designation: Conflicts may arise regarding who the rightful beneficiary is, particularly in cases where multiple parties are involved. Clear documentation can help resolve these disputes.

Being proactive and organized can significantly enhance the likelihood of a smooth claims experience.

FAQ Explained: Life Insurance

What is the difference between term and whole life insurance?

Term life insurance provides coverage for a specific period, while whole life insurance offers lifelong protection and includes a savings component.

Can I change my life insurance policy after purchase?

Yes, many policies allow for adjustments or upgrades, depending on the insurer's terms.

Is life insurance only for older individuals?

No, life insurance can benefit people of all ages, especially those with dependents or significant financial obligations.

How does life insurance affect taxes?

The death benefit from a life insurance policy is generally tax-free for beneficiaries, but there may be tax implications if the policy accumulates cash value.

What happens if I stop paying my life insurance premiums?

Failing to pay premiums can result in the policy lapsing, meaning coverage will end unless reinstated within a grace period.

When it comes to choosing the right coverage, understanding options like seguro progressive can make a significant difference. This insurance offers tailored plans that cater to diverse needs, ensuring peace of mind while you're on the road. With a focus on flexibility and comprehensive support, seguro progressive stands out as a reliable choice for drivers seeking assurance and security.

In the realm of personal insurance, exploring friguey insurance can provide essential insights into protecting your assets. This innovative approach not only covers basic needs but also offers unique features that adapt to individual circumstances. By prioritizing customer satisfaction and comprehensive coverage, friguey insurance sets a new standard in the insurance landscape.