Auto insurance quotes set the stage for a journey through the essential world of auto coverage options, unveiling the multitude of factors that influence your premium costs and coverage selection. By obtaining multiple quotes, you arm yourself with the necessary information to make informed decisions that can save you money and ensure you have the protection you need on the road. Understanding how quotes are derived and what they include is vital in navigating the often complex landscape of auto insurance.

From key elements like driving history and vehicle type to the nuances of policy terminology, this exploration of auto insurance quotes will provide a comprehensive overview that empowers you to negotiate your insurance effectively.

Importance of Auto Insurance Quotes

Influence on Purchasing Decisions

Auto insurance quotes greatly influence purchasing decisions. When consumers are armed with multiple quotes, they can better evaluate the value propositions of each insurance company. The aspects considered in these comparisons often include coverage limits, deductibles, and additional benefits that various insurers might offer. An effective way to understand the dynamics of insurance quotes is by examining the factors influencing pricing:- Coverage Levels: Different policies come with varying levels of coverage. For instance, some may include liability, collision, and comprehensive coverage, while others may offer basic protection.

- Deductibles: The amount you agree to pay out of pocket before your insurance kicks in can significantly affect your premiums. Lower deductibles typically result in higher premiums.

- Discounts: Many insurers provide discounts for safe driving records, bundling policies, or having certain safety features in your vehicle.

- Claims History: A good claims history can often result in lower premiums as it reflects lower risk to the insurer.

Impact on Coverage Options and Pricing

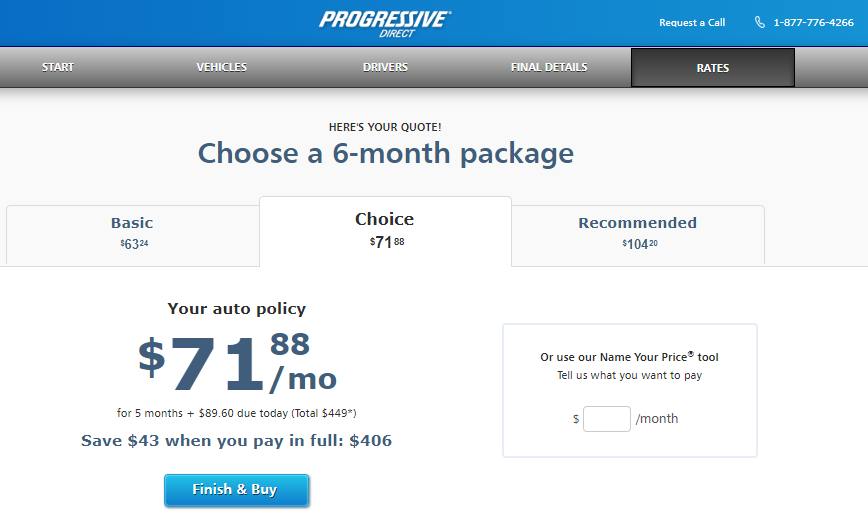

Auto insurance quotes also directly affect the range of coverage options available to consumers. By reviewing multiple quotes, individuals can identify unique provisions and endorsements that may cater to their specific needs. For example, some insurers may offer roadside assistance, rental car reimbursement, or accident forgiveness, which can enhance the value of a policy.Consider the following elements that illustrate how quotes shape coverage options:- Policy Customization: Different insurers have different allowances for customizing policies, allowing customers to add or remove coverage based on personal circumstances.

- Regional Variations: Insurance rates fluctuate based on geographical factors, which means quotes can vary widely depending on where one lives.

- Market Trends: Insurance companies may adjust their pricing based on market trends, making it essential to shop around periodically for the best rates.

- Consumer Behavior: The competitive landscape forces insurers to improve their offerings and provide better pricing structures to attract customers.

Factors Influencing Auto Insurance Quotes

Auto insurance quotes are not generated randomly; rather, they are the result of a complex evaluation process where various factors come into play. Insurance companies leverage an array of data points to assess risk and determine premium costs, ensuring that the quotes reflect the likelihood of a claim being filed. Understanding these factors can empower consumers to make informed decisions about their insurance policies.One of the primary factors influencing auto insurance quotes is the driver's history. Insurers often scrutinize a potential policyholder's driving record, which includes past accidents, traffic violations, and claims history. A clean driving history typically results in lower premiums, while a record marred by accidents or speeding tickets can lead to significantly higher quotes. In fact, drivers who have been in multiple accidents may see their rates increase by as much as 40% or more, depending on the severity and frequency of those incidents.Driving History Impact on Insurance Quotes

The driving history of an individual plays a critical role in determining auto insurance quotes. Insurers evaluate various components of a driver’s past to assess risk. The following are key elements considered:- Accidents: Previous accidents indicate a higher risk, leading to increased premiums. For example, a driver involved in two at-fault accidents in three years may face a premium increase of 20% or more.

- Traffic Violations: Speeding tickets, DUIs, and other infractions raise red flags for insurers. A single DUI conviction can result in a premium hike of up to 50%.

- Claims History: Frequent claims, regardless of fault, can classify a driver as high-risk, causing insurers to adjust rates upwards significantly.

Vehicle Type and Insurance Costs

The type of vehicle insured significantly influences the cost of auto insurance quotes. Insurers examine various attributes of the vehicle to gauge risk levels associated with potential claims. Key factors include:- Make and Model: Luxury and high-performance vehicles typically come with higher insurance rates due to their increased repair costs. For instance, a sports car might incur premiums that are 30% higher than a standard sedan.

- Safety Ratings: Vehicles with high safety ratings may qualify for discounts, as they are less likely to result in severe injuries during accidents. Cars with advanced safety features can also lower premiums.

- Theft Rates: Cars that are frequently targeted for theft will generally have higher insurance costs. Insurers monitor theft statistics, and a vehicle frequently reported stolen may see elevated premiums.

How to Obtain Auto Insurance Quotes

Obtaining auto insurance quotes is a straightforward process that can save you time and money. With the rise of online resources, getting quotes has never been easier. By following a few simple steps and gathering the right information, you can compare quotes from various insurers to find the best deal for your needs.To effectively obtain auto insurance quotes online, you must take a systematic approach. Here is a step-by-step guide to help you navigate the process:Step-by-Step Guide to Request Auto Insurance Quotes Online

Start by identifying a few reputable insurance providers or comparison websites that can provide multiple quotes at once. Consider the following steps for a seamless experience:- Gather Necessary Personal Information: Collect basic details such as your name, address, date of birth, and driver's license number. This information is essential for accurate quotes.

- Compile Vehicle Information: Have details about your vehicle ready, including make, model, year, and Vehicle Identification Number (VIN). If your vehicle has safety features or modifications, include this information as well.

- Choose Coverage Options: Decide on the types of coverage you need, such as liability, collision, or comprehensive coverage. Knowing your preferred deductibles can also refine your quote results.

- Visit Insurance Websites: Navigate to the websites of the selected insurers or use comparison tools. Input the gathered information accurately into the required fields.

- Request Quotes: After entering your details, submit your request. Many sites provide instant quotes, while others may require follow-up communication.

- Review and Save Quotes: Make sure to save all the quotes you receive, as they will be crucial for comparison later.

Information Required for Accurate Auto Insurance Quotes

Gathering accurate information is vital for obtaining precise auto insurance quotes. The following details are commonly required when filling out quote forms:Accurate and complete information leads to more reliable quotes.

- Personal Information: Full name, address, and contact details.

- Driver's License: Number and state of issuance.

- Vehicle Details: Make, model, year, and VIN. Information about mileage, usage (personal or business), and safety features is also beneficial.

- Driving History: Record of previous accidents, traffic violations, or claims. Insurers often ask for this to assess risk accurately.

- Desired Coverage: Types of coverage and limits preferred, along with deductibles.

Tips for Comparing Auto Insurance Quotes Effectively

Once you have received multiple quotes, the next step is to compare them efficiently. The following tips will guide you in making informed decisions:Comparing quotes thoroughly can save you significant amounts on premiums.

- Look Beyond the Price: While cost is essential, consider coverage levels, deductibles, and additional benefits. Assess the overall value each policy offers.

- Check Company Reputation: Research each insurer’s financial stability and customer service ratings. Review sites and consumer reports can provide insights.

- Evaluate Discounts: Inquire about available discounts that may apply, such as multi-policy discounts, safe driver programs, or discounts for vehicle safety features.

- Examine Policy Terms: Read through the terms and conditions of each quote. Understanding policy exclusions and limitations is crucial for making an informed choice.

- Contact the Insurer: If you have questions or need clarifications, reach out to the insurer directly. Their responsiveness can be indicative of their customer service quality.

Understanding Auto Insurance Quote Terminology

Common Terms in Auto Insurance Quotes

Familiarity with the terminology used in auto insurance is essential for comprehending your quotes and ensuring you choose the right coverage. Here are some vital terms you should know:- Premium: The amount paid periodically to the insurance company for coverage. Premiums can vary based on risk factors such as age, driving history, and type of vehicle.

- Deductible: The amount you will need to pay out-of-pocket before your insurance kicks in for a claim. Higher deductibles typically lead to lower premiums.

- Liability Coverage: This coverage helps pay for damages to others if you're at fault in an accident. It typically includes bodily injury and property damage coverage.

- Collision Coverage: This pays for damage to your vehicle resulting from a collision, regardless of fault. It's often a requirement if you have a car loan or lease.

- Comprehensive Coverage: This type of coverage protects against non-collision-related incidents, such as theft, vandalism, or natural disasters.

Differences Among Coverage Types

Understanding the distinctions among liability, collision, and comprehensive coverage is crucial in evaluating your auto insurance needs. Each type serves a different purpose:- Liability Coverage: It's mandatory in most states, as it protects you from financial loss if you injure someone or damage their property in an accident. For example, if you cause an accident that results in $10,000 in damages to another vehicle, liability coverage will pay for those damages up to your policy limit.

- Collision Coverage: This coverage is beneficial if you have a newer or more valuable vehicle. For instance, if you hit a tree and incur $5,000 in damages, collision coverage will cover the repair costs minus your deductible.

- Comprehensive Coverage: This is vital for protection against unforeseen events. If your car is stolen or damaged in a hailstorm, comprehensive coverage would help cover the loss, ensuring you’re not left with a financial burden.

Significance of Deductibles and Premiums, Auto insurance quotes

Both deductibles and premiums play a substantial role in shaping your auto insurance quote. Understanding how they work can help you determine the right balance between cost and coverage.The premium is the price you pay for coverage, while the deductible is the amount you pay when you file a claim.The relationship between deductible levels and premiums is inverse; typically, opting for a higher deductible reduces your premium. For example, if you choose a $1,000 deductible, you may pay less in premiums compared to a $250 deductible. However, it’s essential to assess your financial ability to cover the deductible in case of an accident. Balancing these aspects ensures that you secure adequate coverage without overspending. Thus, a well-informed decision regarding deductibles and premiums can lead to both financial savings and effective risk management in auto insurance.

FAQs

How often should I obtain auto insurance quotes?

It's recommended to shop for auto insurance quotes at least once a year or whenever you experience a significant life change such as moving or buying a new car.

Can my credit score affect my auto insurance quotes?

Yes, many insurance companies consider your credit score when generating quotes, as it can indicate reliability and risk.

Is it better to get quotes from local agents or online?

Both options have advantages; online quotes can be quicker, while local agents offer personalized advice and support.

What should I do if I find a better quote?

If you find a better quote, contact your current insurer to see if they can match or beat it.

Are there any hidden fees in auto insurance quotes?

While quotes should be transparent, always read the fine print to check for any additional fees or exclusions that may apply.

Understanding the importance of health insurance is crucial in today’s world. It provides not just financial protection against unexpected medical expenses but also access to better healthcare services. Without it, a single medical emergency can lead to significant financial strain, highlighting the need for comprehensive coverage that suits individual needs.

When planning for the future, considering life insurance is essential. It ensures that your loved ones are financially secure in the event of your passing, allowing them to manage expenses and maintain their quality of life. Investing in a suitable policy can provide peace of mind and a safety net during uncertain times.